how much is inheritance tax in oklahoma

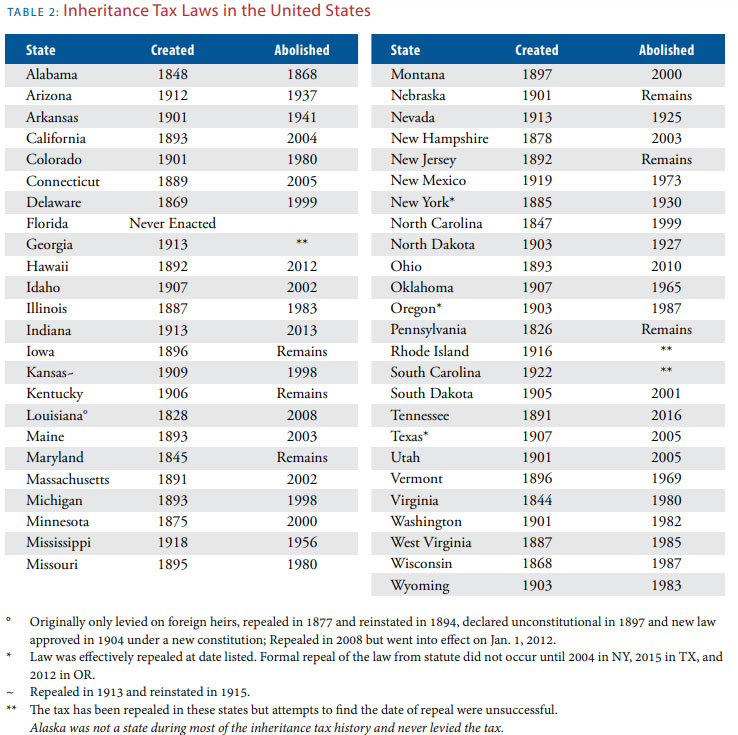

A few states have disclosed exemption limits for. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

Eighth Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1946 And Ending June 30 1948 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

The estate can pay Inheritance.

. The 2022 state personal income tax brackets. Your average tax rate is 1198 and your marginal. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

The tax rate varies. Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a. Get a FREE consultation.

Therefore signNow offers a separate application for mobiles working on. Illinois inheritance tax waiver formoismong mobile users the market share of Android gadgets is much bigger. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520.

There is no inheritance tax Oklahoma. Postic is an attorney at Postic Bates PC. State inheritance tax rates range from 1 up to 16.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a. Before the official 2022 Oklahoma income tax rates are released provisional 2022 tax rates are based on Oklahomas 2021 income tax brackets.

Your estate is worth 500000 and your tax-free threshold is 325000. His practice focuses on estate planning probate real estate trust administration business. The statewide sales tax in Oklahoma is 450.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. There will be no tax due unless the. Get a FREE consultation.

How Much Is Inheritance Tax In OklahomaYou can also join us for a free seminar to. I will be receiving inheritance of about 210000 how much or if any will be taxed in Oklahoma - Answered by a verified Tax Professional. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of.

Oklahoma Income Tax Calculator 2021. The federal annual gift exclusion is now 15000. And remember we do not have.

The federal estate tax exemption for 2018 is 56 million per person.

Do I Need To Pay Inheritance Taxes Postic Bates P C

Death And Taxes Nebraska S Inheritance Tax

Sixth Biennial Report Of The Oklahoma Tax Commission For The Period July 1 1942 To June 30 1944 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

Transfer On Death Tax Implications Findlaw

Eighth Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1946 And Ending June 30 1948 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

Eleventh Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1952 And Ending June 30 1954 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

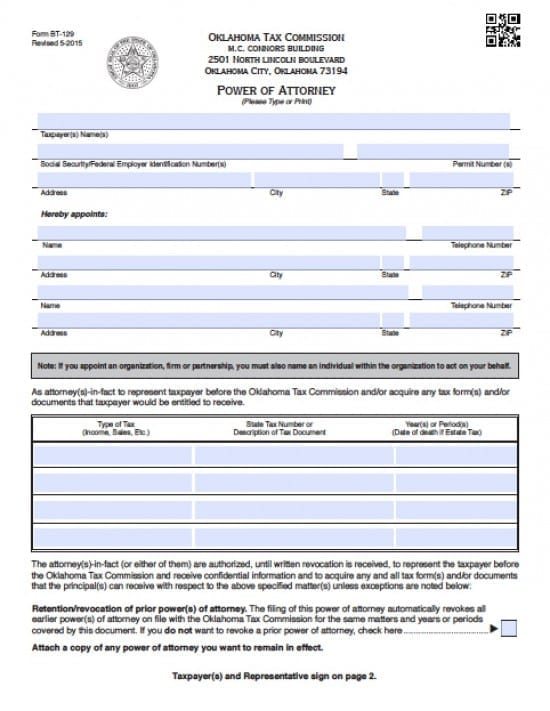

Oklahoma Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

States With No Estate Or Inheritance Taxes

Oklahoma Tax Rates Rankings Oklahoma State Taxes Tax Foundation

State Estate And Inheritance Taxes Itep

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

Federal Estate Tax Exemption 2021 Cortes Law Firm

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Oklahoma Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Free Oklahoma Estate Planning Checklist Word Pdf Eforms

Oklahoma Estate Tax Everything You Need To Know Smartasset

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys